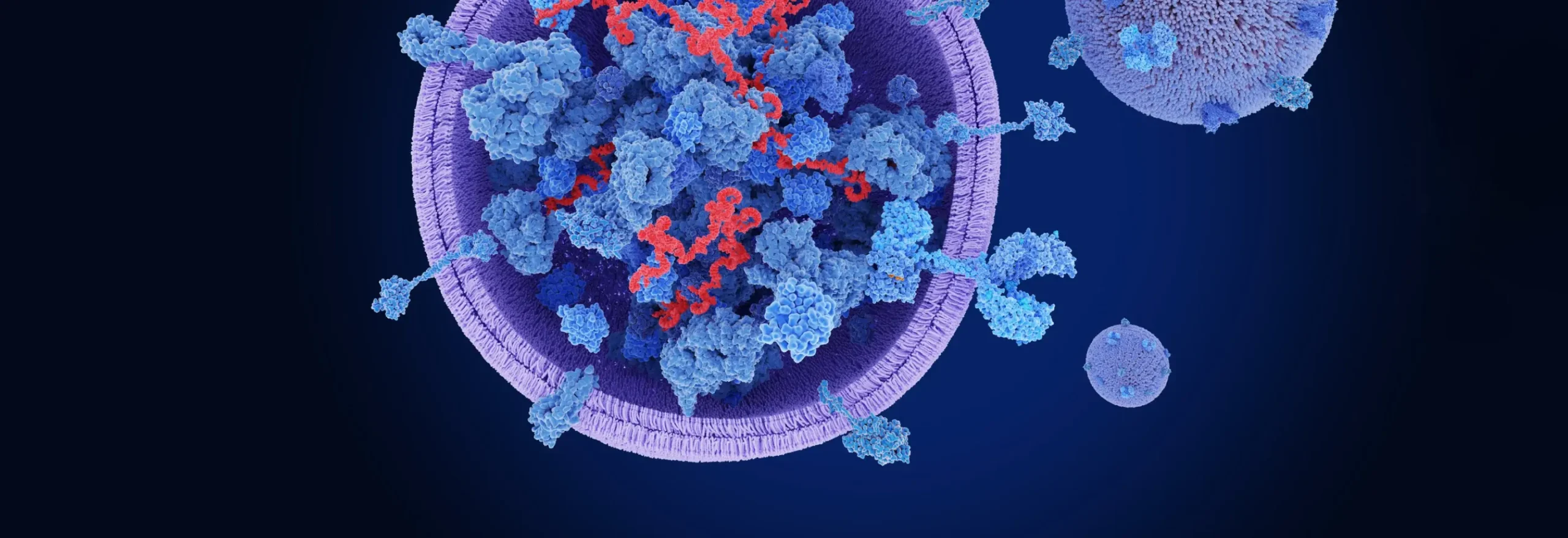

Given the difficulty in delivering naked genetic material across cell membranes, it should come as no surprise that the human body has developed its own delivery systems. Extracellular vesicles (EVs) are nanoscale particles comprising lipid bilayers containing cellular material that are secreted by many different types of cells. They include larger microvesicles, apoptosomes, and migrasomes, which range from 50 nm to 1 mm and exosomes, at 40–160 nm.1

Exosomes are of particular interest, as they have been shown to play an important role in intercellular communication, numerous physiological processes, and disease pathologies.2 They transport not only lipids but DNA and RNA, proteins, enzymes, carbohydrates, cytokines, membrane transporters, and many other bioactive molecules.2-4 Once they reach their target cells, exosomes deliver these materials, which influence proliferation, differentiation, migration, survival, gene expression, cell metabolism, and other functions IN the recipient cells.3

Most exosomes exhibit specific traits correlating to those of their parent cells and are often designed to communicate with specific cell types. For these reasons, exosomes are being explored as disease biomarkers, natural drug-delivery vehicles for immunotherapies, gene therapies, and other drug substances, and in a few cases as drug targets.1

They can be isolated from body fluids, such as semen, urine, milk, bronchoalveolar lavage fluid, and plasma or purposely produced via in vitro cell culture.5 Most of the latter leverage mesenchymal stem cells (MSC) for exosome expression, including bone marrow, umbilical cord, and adipose-derived MSCs.

Exosomes from stem cells are attracting particular interest because they exhibit similar properties to these cells and thus can be used in tissue regeneration and many other therapeutic applications but are easier to store and transport than live cells and do not present immunogenicity and related concerns.2,4 Researchers are also investigating exosomes from dermal, lung, neural, immune, and other cells to enable targeted delivery of drugs to these specific tissues. Plant-derived exosomes, meanwhile, are finding use in nutraceutical products.3

In general, exosomes intended for use in therapeutic applications are generated via cell culture. In addition to the cell type, the particular cell line must be considered, as different cell lines may have different levels of stability as passage numbers increase, and they may secrete different quantities of exosomes under comparable conditions.6 Engineered cell lines are therefore often used to increase expression levels and ensure stability. Use of immortalized cell lines, while not possible with cell therapies, is a practical approach for exosome generation, as they are more cost-effective and also ensure phenotypic and genotypic stability.

Naïve, or natural, exosomes have been shown to exhibit therapeutic benefits.1 MSC-derived exosomes have regenerative and anti-inflammatory properties, while those from lung spheroid cells can reduce the impact of respiratory diseases, those from neural stem cells have been explored as neuroprotective and regenerative therapies, and exosomes from dendritic immune cells exhibit antitumor immune activity. Engineered exosomes, meanwhile, allow for drug loading, greater stability, improved uptake, and enhancement of other performance attributes.3

Most programs are at the preclinical development stage, but a few have progressed into clinical trials. One market research firm estimated the exosome therapy market to be expanding at a compound annual growth rate of 41.1% from a value of $32 million in 2022.7

Exosomes have significant potential as disease biomarkers because they are known to play pivotal roles in disease pathways, including tumor metathesis, and are released by many different types of cells, including those that are healthy, unhealthy, or modified in some way.1 Containing many different bioactive molecules, exosomes are also generally highly representative of their parent cells and include information on the entire genome, even for tumor and other damaged cells, and thus afford greater diagnostic accuracy. In addition, their presence at relatively higher concentrations than many other biomarkers in most bodily fluids enables detection using various liquid biopsy methods. Furthermore, exosomes are relatively easy to isolate and concentrate, providing higher sensitivity, and fairly stable under reasonable, low-temperature storage conditions.

For these many reasons, exosomes are being investigated as biomarkers for many different types of diseases. Over half of projects involve the detection of many different types of cancer (e.g., breast, lung, liver, prostate, gastric, colorectal, and different carcinomas).8,9 Other diseases for which exosome-based diagnostics are being developed include neurological diseases, such as Parkinson’s disease and chronic traumatic encephalopathy (CTE), cardiovascular diseases, and lung diseases, such as asthma.9 They are also being investigated for the diagnosis of a variety of pregnancy-related issues.

The therapeutic potential of exosomes largely relates to the fact that these nanoparticles are native to the body.8 Consequently, they are not seen by the immune system as foreign and do not illicit undesirable immune responses.

Exosomes also have potentially higher stability and greater targeting capability than man-made delivery vehicles, allowing for reduced dosages and dosing frequencies. Lipid nanoparticles (LNPs) and many other current carrier technologies, on the other hand, suffer from dose-dependent toxicity and ineffective delivery to target tissues.1

Engineered exosomes can support high drug loading levels for many different types of drug substances, ranging from DNA and RNA to viruses, proteins, antisense oligonucleotides (ASO), many types of RNA molecules, and small molecule APIs.8 For the latter, exosomes also enable enhanced solubility, which is an issue for the majority of chemical drug candidates today. Many exosomes also have the ability to cross the blood–brain and air–blood barriers.1

These many possible advantages are driving exploration of exosomes as delivery vehicles across many indications, including infectious, cardiovascular, neurological, orthopedic, metabolic,8 dermatologic,2 and many other diseases,8 as well as many subspecialties of surgical practice.4 According to the CAS Content Collection™, the areas of greatest focus include cancer, neurological and neurodegenerative diseases, lung diseases, and wound healing.9

The cargos can be loaded after the exosomes have been purified, within cells after exosome expression, or as part of exosomes expressed by cells. In addition, they can be attached to the surface or the interior of the exosome.

Manufacturing exosomes requires their production, isolation from cellular material, purification, and in some cases drug loading and/or other modifications following purification. One of the main hurdles to bringing exosome-based products to the market is the need to establish truly robust, scalable manufacturing processes.

Culture conditions have a significant impact on exosome production — not just the quantity but the contents contained within the generated nanoparticles. Two-dimensional versus three-dimensional cultures, as well as the type of bioreactor (e.g., stirred-tank, rotating-wall, fixed-bed, hollow-fiber) must be evaluated to determine which approach provides the desired exosomes in the highest yields.1

The biggest challenge, however, relates to purification of exosomes, as they must be separated from the other contents of the cultured cells, including other extracellular vesicles, host-cell DNA, host-cell proteins and peptides, and other cellular debris.1,8 These impurities are present in greater quantities and are much larger than the exosomes. In addition, developing standard methods is difficult, as each type of exosome exhibits physicochemical properties.

Many of these impurities can be difficult to separate from the desired exosomes. Methods that have been used include centrifugation (e.g., ultra, density-gradient, filtration, differential), tangential-flow filtration (TFF), immunoaffinity capture, precipitation, ion-exchange and size-exclusion chromatography, and microfluidic technologies, among others.1,8 The potential for exosome degradation during purification leading to negative impacts on structural integrity and functionality is an added complication.5

Centrifugation methods generally provide low recoveries and are time-consuming and expensive, precluding their use for commercial production. TFF is promising but often must be used in conjunction with other techniques, such as immunocapture or chromatography, to reduce the contents of all impurities to acceptable levels. Microfluidics, meanwhile, has yet to be validated for GMP production. Some commercial kits are available to aid in small-scale separation of exosomes, but they are expensive and cannot ensure optimal results.8

Exosome heterogeneity in terms of both quantity and content poses difficulties for the establishment of industry-wide analytical standards as well. Common techniques employed for exosome identification, characterization, and purity analysis are intended to evaluate their morphology, density, surface markers, and contents. They include nanoparticle tracking analysis, transmission electron microscopy (TEM) and cryo-EM, atomic force microscopy, nano-flow cytometry with fluorescent detection, western blot, enzyme-linked immunosorbent assay (ELISA), protein concentration and identification methods, genetic sequencing, lipid analysis, and so on.

Drug loading for therapeutic applications can be achieved using either passive or active methods or during exosome expression.1,5,7 Passive methods involve incubating the exosomes in the presence of the payload molecule at a specific temperature to enable its diffusion into the interior. While the simplest approach, loading efficiencies are often low, and control of content from one exosome to another is difficult. Active methods include sonication, electroporation, surfactant-enabled permeation, and dialysis. These techniques, however, lead to damage of the exosome membrane and thus are impractical for production of GMP therapeutics.

Exosomes with loaded drug substances can also be generated during cell culture via transfection of plasmids encoded to produce the active substance packaged in the exosomes. It is also possible to load drug substances onto the surfaces or in the interiors of exosomes via in situ assembly and synthesis processes.

Most of these methods suffer from suboptimal loading/expression levels. Greater understanding of exosome generation and release is needed to enable development of more cost-effective and efficient exosome manufacturing and purification processes for both naïve and engineered exosomes without/with loaded cargoes (interior and exterior).

As an emerging modality, exosome-based diagnostics and therapeutics face regulatory uncertainties. The heightened level of interest has, however, attracted the interest of regulatory bodies, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), both of which are drafting guidelines for their manufacture and use.10 The lack of definitive guidance and standardization across agencies poses difficulties. In the meantime, trade groups, such as the International Society for Extracellular Vesicles (ISEV), are supporting developers with clarity on the definition of exosomes in the pharmaceutical context and recommended practices for isolation and purification.

One particular issue with exosomes is their classification. As cellular products that contain genetic material, they can be viewed as traditional biologic products and as gene therapies. The two drug classes are regulated under different guidelines, and the need to meet regulatory requirements for quality and safety for both can be a huge hurdle as well.

In June 2022, approximately 70 clinical trials involving exosomes were reported on various registries.11 About two-thirds involved exosomes derived from MSCs. The most common trials involving therapeutic products target SARS-CoV-2 infections and/or acute respiratory distress syndrome.11

In 2023, a total of 120 exosome-based candidates were in development, with approximately 40% of the candidates under investigation having reached the clinical stage of development, and seven of them progressing to later-stage studies. Overall, just under one-third of candidates targeted some form of cancer.

Aegle Therapeutics, Aruna Bio, Avalon Globocare, Capricor Therapeutics, Codiak Biosciences (now defunct), Direct Biologics, Exopharm Ltd, Organicell Regenerative Medicine, RION, and United Therapeutics are some of the companies that have pursued or are pursuing clinical trials with exosome-based candidates.1,10,12 These companies have used exosomes derived from bone-marrow-derived MSCs, platelets, human amniotic fluid, cardiosphere-derived cells, and exosomes. There are also clinical trials underway using plant-derived exosomes to treat colon cancer, oral mucositis related to neck and head cancer, and insulin resistance and inflammation in ovary syndrome patients.8

In addition to studies involving exosome-based therapeutics, there are several clinical trials exploring the use of exosomes in diagnostic applications. Many are focused on the diagnosis of different types of cancer, including various forms of breast, ovarian, lung, colon, and pancreatic cancers.8

It is interesting to note that some of these therapies leverage the ability of exosomes to be recognized as “self” by the human body to deliver active drug substances known to be effective but to cause unacceptable toxic side effects when delivered systemically. One example is exoIL-12™, originally developed by Codiak Biosciences and since acquired by Lonza, which is looking to find a partner to take the candidate further. Recombinant interleukin 12 (IL-12) exhibits excellent antitumor efficacy in preclinical models but results in unacceptable side effects in humans. Loading of IL-12 onto the surface of exosomes allows for potent and prolonged activation of T and natural killer (NK) cells in the tumors without any Grade 3 or higher adverse events.13 Codiak also developed a candidate designed to deliver a STING (cGAS/stimulator of interferon gene) agonist that exhibits 100-fold higher potency than the free agonist with a much better safety profile.

Unfortunately, due to the funding issues facing the biopharmaceutical industry in recent years and challenges recruiting patients, some trials have not yet started, while others have had to be halted.5 In addition, some candidates that have realized positive results in early-phase trials have not yet been taken further. These trials include exosome-based treatments for a variety of indications, from cancer to infectious diseases to autoimmune disorders (e.g., Crohn’s diseases, ulcerative colitis), osteoarthritis, Alzheimer’s disease, depression/anxiety, wound healing, skin diseases, bone tissue defects, dry eyes, diabetes, and polycystic ovary syndrome, among others.

Despite the funding challenges, the potential presented by exosomes continues to entice many biotech and pharmaceutical companies to pursue exosome-based product development. According to one market research report, over 60 companies and academic/research institutes have or are pursuing the development of exosome-based therapeutics and diagnostics.7 They have managed, according to the report, to raise approximately $500 million from strategic investors.

Some companies have focused on developing candidates based on naïve exosomes (with and without loading of drug substances), while others have elected to create engineered exosomes. The former include GS Therapeutics, Avalon, Aegle Therapeutics, ExoCoBio, AgeX Therapeutics, Kimera Labs, and United Therapeutics, while Capricor, Evox, Ilias, Carmine Therapeutics, ReNeuron, Anjarium, Adipomics, Brainstorm Cell Therapeutics, Exocure Biosciences, Empty Cell, ILIAS Biologics, The Cell Factory, Evox Therapeutics, Exopharam, Carnine Therapeutics, and TriArm Therapeutics are representatives of the latter.1,12 A few are exploring both approaches, such as EverZom.

Most of the candidates developed by these companies have not proceeded past the preclinical stage. Many of the companies have focused on establishing platform technologies that can be applied to multiple indications. Other examples of companies that have explored preclinical candidates include VivaZome, Vitti Labs, Xollent Biotech, Exocel Bio, and Florica Therapeutics.9

Mercy Bioanalytics, Bio-Techne, Exosome Sciences, Exosomics, Echo Biotech, the University of Texas MD Anderson Cancer Center, a collaboration between Harvard Medical School, and Wenzhou Medical University (China), and researchers at the University of California, San Francisco Medical Center have been involved in efforts to develop diagnostic technologies leveraging exosomes.1,12

While some large biopharmaceutical companies are investing in the development of exosome-based therapeutics and diagnostics, the majority of candidates under investigation belong to small and emerging biotech firms. A few have been able to attract sufficient funding to support development and implementation of in-house manufacturing solutions, but many must rely on outsourcing partners for many of these activities. That has driven interest in exosome production and purification by contract development and manufacturing organizations (CDMOs).10

Some of these CDMOs are established firms supporting the development and manufacturing of traditional and next-generation biologics, such as Lonza. Others have been involved in providing stem-cell-related products and services, such as RoosterBio.1

Many are new, smaller firms themselves that have gotten involved in supporting developers in what they view as a highly promising field. Some are offering outsourcing services in addition to developing their own exosome-based candidates. ExoXpert, EXO Biologics, and EverZom, for example, claim to have established proprietary upstream and downstream manufacturing solutions.1,10 Others offer specialized media products, research reagents, and analytical technologies, including Clara Biotech, NanoView Biosciences, System Biosciences, and The Cell Factory.1

As natural packages of genetic and other cellular material, exosomes hold real promise as alternative drug-delivery vehicles with better targeting capabilities and fewer side effects than currently used, synthetic technologies. With potential to deliver nearly all types of drug substances from viral vectors as gene therapies to multiple forms of RNA, DNA, proteins, and small molecule drug substances, to name a few, exosomes are creating real excitement as a new therapeutic modality. Their production by most cell types in high concentrations also makes them attractive as biomarkers of disease.

Unfortunately, for various reasons, few exosome-based candidates have made it into clinical trials, and the majority that have are struggling with insufficient patient enrollment and funding shortages. Current developers must overcome these hurdles, as well as regulatory uncertainty and numerous manufacturing challenges, if the potential of exosomes is to be realized in the form of approved therapeutic and diagnostic products. None of the hurdles are unsurmountable, however, and given the early clinical data generated to date and the tenacity and innovativeness of biopharmaceutical researchers, the outlook remains bright.

Originally published on PharmasAlmanac.com on May 9, 2024.